‘More can be done to rein in the profits of oil and gas companies and invest in a transition to a green economy.’

A Call for Public Support for a greener energy future from Canadians for Tax Fairness

Posted June 12th, 2024 on Niagara At Large

This past June 7th , CEOs from some of the largest oil and gas companies testified before a parliamentary committee in Ottawa and were grilled by MPs on the profits and emissions reduction efforts of the industry.

This past June 7th , CEOs from some of the largest oil and gas companies testified before a parliamentary committee in Ottawa and were grilled by MPs on the profits and emissions reduction efforts of the industry.

The committee meeting was a revelation, and after two and a half hours of questioning, one thing was clear: they won’t invest in sustainability unless we pay.

Here’s the problem.

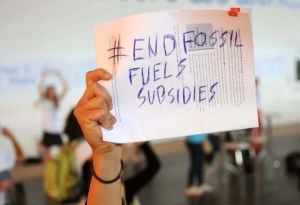

Canadians are already subsidizing fossil fuel production with billions of dollars in tax credits and capital cost allowances, despite the industry raking in record profits. from 2021 to 2023, the oil and gas industry recorded $132 billion in pre-tax profits, second only to the real estate industry among non-financial industries.

Among the 10 most profitable industries during this period, it (the oil and gas industries) paid the lowest effective tax rate, just eight per cent.

None of these companies have meaningfully invested in emissions reduction.

Instead, they are asking for more handouts and for the government to fund more than 50 per cent of Pathways Alliance’s dubious carbon capture project.

If their lobbying is successful, the oil and gas sector could further increase their profits and emissions while reducing their tax burden. THAT IS WHY WE MUST ACT NOW.

Research from C4TF (Canadians for Tax Fairness) was referenced in the June 7th committee meeting and helped to hold the ceos accountable. But more can be done to rein in the profits of oil and gas companies and invest in a transition to a green economy.

CAN YOU PITCH IN $29, OUR AVERAGE DONATION, TO HELP DEFEND TAX FAIRNESS FROM BIG OIL CEOS?

OUR RECOMMENDATIONS:

- * Eliminate all subsidies for the fossil fuel industry.

- * Establish clear conditions on green tax credits so that they have clear public benefits.

- * Raise the corporate income tax rate and make it progressive.

- * Implement an excess profits tax on companies making extraordinary profits or disproportionately benefiting from global crises.

- * Phase out free emissions allowances in the output-based pricing system.

-

Katrina Miller, Executive Director | Directrice générale, Canadians for Tax Fairness |Canadiens pour une fiscalité equitable

Katrina Miller, Executive Director | Directrice générale, Canadians for Tax Fairness |Canadiens pour une fiscalité equitable

For More on Canadians for Tax Fairness and how you can support its efforts, click on – Canadians for Tax Fairness | Canadians for Tax Fairness

NIAGARA AT LARGE Encourages You To Join The Conversation By Sharing Your Views On This Post In The Space Following The Bernie Sanders Quote Below.

“A Politician Thinks Of The Next Election. A Leader Thinks Of The Next Generation.” – Bernie Sanders