“The federal government has so far refused to deny (COVID-19) support to companies that operate in tax havens. … We’ve called on the federal government to deny funding to corporations that abuse tax havens to avoid Canadian taxes.” – Canadians for Tax Fairness

A News Release from Canadians for Tax Fairness

Posted April 23th, 2020 on Niagara At Large

(Niagara At Large is posting this News Release with KUDOS to this citizens group, Canadians for Tax Fairness, for demanding that Canada’s federal government stop giving our tax dollars to corporations that either refuse or don’t want to pay taxes here.)

(Niagara At Large is posting this News Release with KUDOS to this citizens group, Canadians for Tax Fairness, for demanding that Canada’s federal government stop giving our tax dollars to corporations that either refuse or don’t want to pay taxes here.)

Pressure is mounting on governments to ensure COVID-19 funding doesn’t go to companies that exploit tax havens or use public funds to pad their profits.

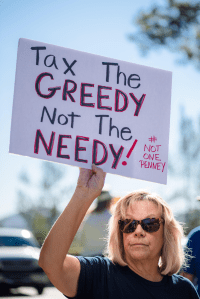

They suck as much out of Canada and Canadians as they can stuff in their safes, then they take it down to a haven where they don’t pay one plug nickel in taxes. Now these deadebeats want a bailout during this pandemic. Tell Trudeau and his Liberals not to give it to them.

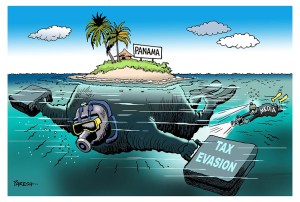

The government of France has just joined Denmark and Poland in not allowing corporations that operate in tax havens to benefit from its COVID19 bailout fund. France and Denmark are also restricting corporate recipients of state aid from using funds to pay dividends and buying back their own shares.

Three weeks ago, Canadians for Tax Fairness called on the federal government to apply similar restrictions, to increase transparency and accountability over these funds, and to recover amounts that are ultimately not needed through measures such as an excess profits tax.

This past week NDP and Bloc MPs questioned why the Liberals aren’t doing the same as Denmark and Poland, which recently made headlines for refusing COVID-19 aid to any company registered in a tax haven. Quebec Solidaire also pressed the Quebec government not to provide one penny for any corporation that refuses to play by the rules by hiding their wealth offshore.

The federal government has so far refused to deny support to companies that operate in tax havens. As the Toronto Star reported, Prime Minister Justin Trudeau said he didn’t want to punish workers by refusing support to companies that take advantage of tax havens.

The federal government has so far refused to deny support to companies that operate in tax havens. As the Toronto Star reported, Prime Minister Justin Trudeau said he didn’t want to punish workers by refusing support to companies that take advantage of tax havens.

We agree that delivering support to Canadians affected should take priority, but that doesn’t mean the government shouldn’t put conditions on federal funding to prevent corruption and fraud, to ensure corporations don’t use public funds to profiteer, and that they contribute their fair share in taxes.

We’ve called on the federal governments to:

- Deny funding to corporations that abuse tax havens to avoid Canadian taxes, or to numbered and anonymous companies that don’t reveal their real owners

- Require large corporations that receive funding to publicly disclose their finances on a country by country basis

- Publicly report details on all federal funds dispersed

- Prohibit corporate stock buybacks, executive bonuses, golden parachutes and shareholder dividend payouts for at least one year for corporations receiving funding

- Consider measures such as an excess profits tax to recover funds from companies that ultimately don’t need this funding

- Proceed with measures to stop multinational corporations and wealthy individuals from exploiting tax havens to avoid Canadian taxes

As we revealed three years ago, over 90% of Canada’s largest corporations have at least one subsidiary in countries considered tax havens. However, not all necessarily abuse these affiliated companies to avoid Canadian taxes. In these exceptional times, a number of larger employers may require federal funding to stay afloat, provide necessary goods and services and to keep their employees on the payroll. That shouldn’t be denied.

As we revealed three years ago, over 90% of Canada’s largest corporations have at least one subsidiary in countries considered tax havens. However, not all necessarily abuse these affiliated companies to avoid Canadian taxes. In these exceptional times, a number of larger employers may require federal funding to stay afloat, provide necessary goods and services and to keep their employees on the payroll. That shouldn’t be denied.

However, federal and provincial governments should ensure that public funding doesn’t go to multinational corporations that abuse tax havens to avoid Canadian taxes. This can be determined by requiring multinational corporations and all those that receive public funding to publicly disclose their finances on a country by country basis.

Public funding also shouldn’t go to numbered or anonymous shell companies that don’t reveal their real, or “beneficial” owners.

They are the deadbeat pics in Canada. They make billions here, exploiting us and our infrastructure and way of life, then they take their fortunes off-shore to havens where they don’t pay taxes here. And now, with so many people suffering in Canada in the wake of this pandemic, they want to cash in on some of the bailout money. And so far, the Trudeau government seems willing to let them. Tell them to stop.

While so many are making enormous sacrifices for the common good, emergencies and crises also provide fertile ground for corruption, fraud and money-laundering—and make use of numbered and anonymous companies to do so. Publicly disclosing the beneficial owners of companies would also help reduce tax dodging through numbered shell companies and counter Canada’s embarrassing money laundering problem.

We’ve also called on the federal government to ensure public funding doesn’t go to those who don’t ultimately need it, by including a prohibition on stock buybacks, executive bonuses, golden parachutes and shareholder dividend payouts for at least a year afterwards; to include provisions to recover and tax back amounts from businesses that ultimately didn’t need it with measures such as an excess profits tax, and include limits on executive compensation.

The federal government also needs to address the underlying problemby moving forward with significant domestic and international reforms to crack down on corporations and wealthy individuals from exploiting tax havens, and prosecuting those who use them to evade taxes. As we highlighted earlier this month, Canada marked the fourth anniversary of the Panama Papers without a single conviction, while other countries have recouped millions.

France, Denmark and Poland should be commended for taking a strong stance against providing bail-out funds to companies operating in tax havens.

France, Denmark and Poland should be commended for taking a strong stance against providing bail-out funds to companies operating in tax havens.

However, the list of tax havens only includes a dozen jurisdictions, none in Europe, and leaves out some big offenders like the Bahamas, as groups such as Oxfam have pointed out.

It’s also not clear if the consequences companies could face for failing to meet these conditions would be considerable deterrents. While the details have yet to be worked out, the political symbolism is significant.

Every day, the federal government announces more in assistance for those affected by this crisis. These and additional supports are desperately needed, but as the costs for this mount, we need to ensure that this funding isn’t abused by those who don’t need it and that everybody—and especially corporations and wealthy individuals—pay their fair share.

About Canadians for Tax Fairness – Canadians for Tax Fairness advocates for fair and progressive tax policies aimed at building a strong and sustainable economy, reducing inequalities and funding quality public services.

About Canadians for Tax Fairness – Canadians for Tax Fairness advocates for fair and progressive tax policies aimed at building a strong and sustainable economy, reducing inequalities and funding quality public services.

Our vision is a country where taxation is regarded as a way to invest in Canada and Canadians. We believe in a progressive tax system where all individuals and corporations pay their fair share.

We believe that Canada in the 21st century should be a society in which economic disparities are decreasing, basic needs are met by investing in high-quality public services, economic policies are designed to create good quality jobs and protect our environment, and the will of the people drives our political process.

For more information on Canadians for Tax Fairness, click on –://www.taxfairness.ca/en

For related stories, click on the following – https://www.businessinsider.com/coronavirus-companies-tax-havens-banned-denmark-poland-bailout-2020-4?utm_medium=social&utm_campaign=sf-insider-main&utm_source=facebook.com&fbclid=IwAR3aAE-U50h3jYEVGHxo3utfIhFAD2y73JvveAagF8nMbmUHdb28Of-WZH4

For related stories, click on the following – https://www.businessinsider.com/coronavirus-companies-tax-havens-banned-denmark-poland-bailout-2020-4?utm_medium=social&utm_campaign=sf-insider-main&utm_source=facebook.com&fbclid=IwAR3aAE-U50h3jYEVGHxo3utfIhFAD2y73JvveAagF8nMbmUHdb28Of-WZH4

And – https://www.cbc.ca/news/business/cra-corporate-taxes-1.5179489

Here is one from this great organization that Niagara At Large posted about four years ago. We got to get these deadbeats to start paying their fair share of taxes in Canada, or get the hell out – https://niagaraatlarge.com/2016/03/12/a-citizens-call-to-canadas-finance-revenue-ministers-please-stop-all-the-tax-dodging-in-the-upcoming-federal-budget/

NIAGARA AT LARGE encourages you to join the conversation by sharing your views on this post, along with your name (not a pseudonym), in the space immediately below the Bernie Sanders quote.

While I agree that companies that “shelter” assets in tax havens should not receive any funding at this time, I think that to call them as “abusing” tax havens is not right BECAUSE they are only taking advantage of tax legislation. Don’t get me wrong, it is wrong not to exclude them from benefits given to struggling Canadian entities. They are Canadian, but I don’t believe that they are struggling.

LikeLike

Imagine how far those hidden billions could go toward restoring the economy and covering the costs the government has had to shell out resulting from this disaster.

LikeLike